| ANA Reports Profit for Fiscal Year 2006 - three consecutive years of record revenue, two of record operating profit - |

|

|

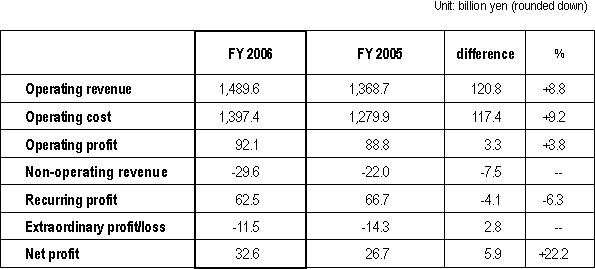

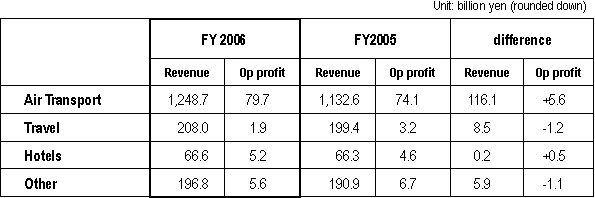

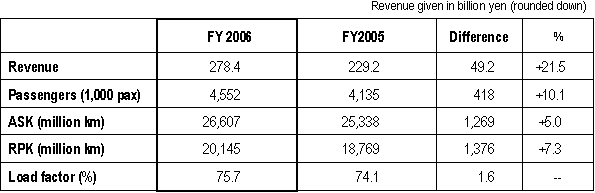

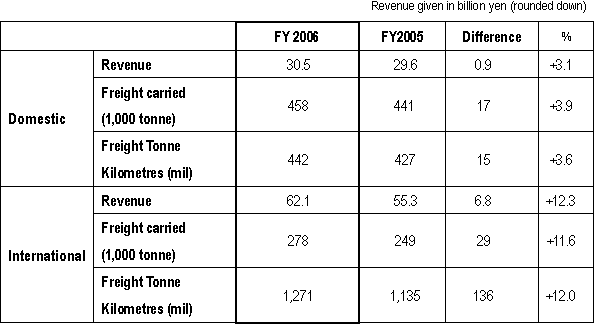

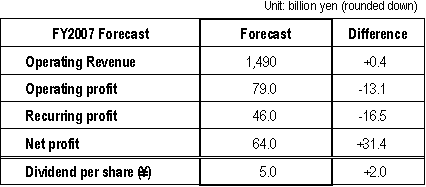

TOKYO April 27, 2007 - ANA Group today posted a record consolidated operating profit of ¥92.1billion on a record consolidated revenue of ¥1.48 trillion for the twelve months ended March 31, 2007. This represents a year-on-year improvement of 3.8% and 8.8% respectively. Consolidated net profit for the period was ¥32.6 billion, the second highest in ANA’s history and 22.2% better than the FY2005. The Group’s highest net profit was posted in FY 2000. Costs incurred by the return of leased aircraft resulted in a 6.3% drop in recurring profit to ¥62.5 billion. “We have seen strong demand for both business and leisure travel in tandem with the performance of the Japanese economy as whole,” said Mineo Yamamoto, President and CEO of ANA. “Coupled with improvements to our network, more flights and new fares, these have contributed to the excellent results announced today”. “However, profit has been squeezed by a fuel bill that is 31.3% higher than last year. We will keep doing our best to tackle rising costs, and thank our customers, who have had to share part of that burden, for their loyalty,” he continued. Air Transportation Segment Domestic Passenger Services All in all, the number of passengers carried on domestic routes increased 2.2%, despite 2006 being a year with no specific events to stimulate demand, such as the previous year’s Aiichi World Expo, which buoyed up the number of passengers travelling on domestic services in 2005. International Passenger Services Strong demand for business travel continued unabated throughout FY2006. In addition, leisure travel demand grew strongly, stimulated by marketing campaigns for the Ecowari promotional fare and for destinations in China. The addition of Chicago to ANA’s North America network, more flights to Singapore and China, and the down-gauging of aircraft to better match demand on flights between Osaka (Kansai) Qingdao and Xiamen in China, contributed to the successful result in terms of revenue and passenger numbers. Travel to, from and via Narita Airport was significantly improved by the move to new facilities in the South Wing of Terminal 1, together with ANA’s fellow Star Alliance member carriers. Not only were connecting times shortened, but the whole experience was made more convenient and simple by the introduction of shared facilities, including new lounges, and common use self service kiosks equipped with ANA’s Smart e-Service, which allow passengers to collect their boarding pass in a matter of seconds. Cargo On domestic routes, increased economic activity spurring demand and an increase in the number of late night cargo flights contributed to a 3.1% increase in revenue and a 3.6% increase in Revenue Tonne Kilometres (RTK) flown. International cargo services performed particularly well with increases in loads, revenue and RTKs in excess of 10% respectively. This strong performance can be attributed to increased flights to North America, China and the rest of Asia. Forecast for FY2007 The posting of an extraordinary profit on the sale of ANA’s hotel holdings is expected to boost consolidated net profit to record levels, despite a forecast extraordinary loss on the accelerated retirement of aircraft to renew the fleet. The price of fuel is expected to continue at an elevated level, exerting strong downward pressure on consolidated operating profit and recurring profit. For the first time since FY 1992, ANA is expecting to pay a dividend of ¥5 per share. For details, please refer to the charts below. |

| Contact: Rob Henderson, ANA Public Relations: r.henderson@ana.co.jp |

Notes for Editors |

| Consolidated Financial Results |

|

| Financial Results by Segment |

|

| Domestic Air Transportation |

|

| International Air Transportation |

|

| Cargo |

|

| FY2007 Forecast Forecast |

|