ANA Group's Financial Highlights

FY2024 Financial Results

In the environment of the airline business, passenger demand continued to recover, despite concerns about geopolitical risks in Ukraine and the Middle East region.

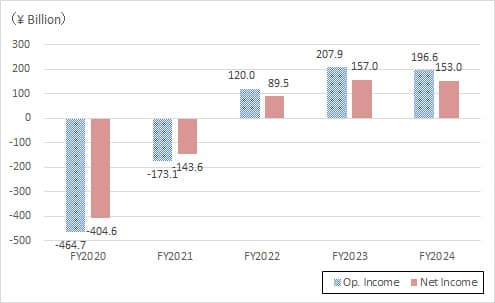

Under these social and economic conditions, revenues increased mainly in the airline business, resulting in operating revenue of ¥2,261.8 billion (up 10.0% year-on-year). How ever operating income was ¥196.6 billion (down 5.4% year-on-year), down from the same period last year, due to increased expenses resulting from an increase in maintenance associated with the expansion of the scale of operations and investments in human resources. In addition, various compensation payments related to aircraft etc. gains an ordinary income of ¥200.0 billion (down 3.6% year-on-year), and net income attributable to owners of the parent of ¥153.0 billion (down 2.6% year-on-year).

Consolidated Financial Summary (Years ended March)

| FY2023 (Results) | FY2024 (Results) | Difference | Change (%) | |

|---|---|---|---|---|

| Operating Revenues | 20,559 | 22,618 | 2,059 | 10.0 |

| Operating Expenses | 18,480 | 20,652 | 2,172 | 11.8 |

| Operating Income | 2,079 | 1,966 |  112 112 |

5.4 5.4 |

| Non-Op. Gains/Losses |  2 2 |

34 | 37 | |

| Recurring Income | 2,076 | 2,000 |  75 75 |

3.6 3.6 |

| Extraordinary Gains/Losses |  28 28 |

35 35 |

7 7 |

|

| Net Income | 1,570 | 1,530 |  40 40 |

2.6 2.6 |

| EBITDA*1 | 3,502 | 3,452 |  49 49 |

1.4 1.4 |

- *1.EBITDA = Op. Income + Depreciation and Amortization

Operating Income and Net Income

(Years ended March)

FY2025 Earnings Forecast (Announced on October 30, 2025)

Due to factors such as reduction in expenses as the fuel market prices was lower than initial expectations and the yen appreciated during the first half of the fiscal year as well as the expected increase in full-year international cargo revenue following the consolidation of NCA as a subsidiary in August, we anticipate that operating revenues is forecast to be ¥2,480.0 billion (an increase of ¥110.0 billion from the previous announcement), the operating income is forecast to be ¥200.0 billion (an increase of ¥15.0 billion), and ordinary income is forecast to be ¥194.0 billion (an increase of ¥19.0 billion). Additionally, with the recording of an extraordinary gain related to the acquisition of NCA and other factors, the net income attributable to owners of the parent is forecast to be ¥145.0 billion (an increase of ¥23.0 billion).

The dividend forecast for fiscal year 2025 remains unchanged at ¥60.0 per share, as announced previously.

| Consolidated Financial Forecast | Forcast for FY2025 | FY2024 | Differnce |

|---|---|---|---|

| Operating revenues | 24,800 | 22,618 | 2,182 |

| Operating income | 2,000 | 1,966 | 34 |

| Ordinary income | 1,940 | 2,000 |  60 60 |

| Net income attributable to owners of the parent | 1,450 | 1,530 |  80 80 |

Relation Links