ANA HOLDINGS NEWS

ANA HOLDINGS Financial Results for the Three Months

ended June 30, 2015

TOKYO, July 29, 2015-ANA HOLDINGS (hereinafter “ANA HD”) today reports its financial results for the three months ended June 30, 2015.

- Overview

- ・Revenues increased by 7.0 % compared to the same period of the previous year to ¥413.8 billion mainly due to firm growth in passenger business.

- ・Although operating expenses were 2.8% higher, reflecting expansion in ANA’s network and capacity, improved efficiency and cost restructuring drove strong increases in operating income, ordinary income and net income attributable to owners of ANA HOLDINGS INC.

- ・Despite downside risks to the economy in overseas markets, the Japanese economy continued to recover gradually, with signs of a rebound in capital investment and personal consumption during the first quarter. In addition, the outlook for the Japanese economy is continued gradual recovery due to factors including the positive impact of various government policies.

- ・During fiscal 2014, ANA expanded its international network at Haneda (Tokyo) and strengthened connectivity between its domestic and international flights. In the current fiscal year ANA is working to bolster the international network at Narita, strengthening its position as an international hub, based on our dual-hub strategy in the Tokyo metropolitan area airports.

- ・ In addition to remaining the only Japanese airline to hold SKYTRAX’s highest 5-Star rating, receiving the accolade for the third consecutive year, ANA also won awards for ‘World’s Best Airport Services’ and ‘Best Airline Staff in Asia’.

Air Transportation

- 1.Domestic Passenger Services

- ・The expansion of the Shinkansen bullet train network into the Hokuriku area changed the situation of competition in the market between airlines and railways. However ANA introduced countermeasures such as deepen optimization on supply and demand and flexible fares to stimulate demand for air travel.

- As a result of the above, revenues from domestic passenger services rose ¥3.9 billion (up 2.7% year-on-year).

- 2.International Passenger Services

- ・International passenger numbers and revenues both increased due to steady business demand and growing numbers of in-bound travelers to Japan.

- ・Establishing a new route in June between Narita - Houston captured demand from/to Central and South America. ANA also increased the frequency on Narita-Singapore route, enhancing convenience for transit passenger between North America and Asian cities.

- ・ANA also worked to promote its brand and stimulate demand in overseas. ANA INSPIRATION was the leading sponsor of the first major on the US women's professional golf (LPGA) tour and ANA has also become the LPGA's official airline, boosting the brand's global profile.

- ・New services include the start of ANA SKY LIVE TV from May on particular aircraft, which shows real-time television programming of news and sports.

- As a result of the above, revenues from international passenger services rose ¥10.0 billion (up 9.2% year-on-year).

- 3.Cargo Services

- ・In domestic cargo services, ANA introduced a new sales system designed to facilitate space availability at the real-time. However, as a result of a decrease in the supply for fresh produce because of typhoons and other inclement weather and a reduced volume of international cargo transferred to domestic flights due to yen depreciation, both freight volume and revenues decreased year-on-year.

- ・In international cargo services, ANA worked to capture trilateral traffic demand between North America and Asian cities via Japan, but as a result of the stagnant cargo market, both on flights departing Japan for China and other Asian countries, and also on flights to Japan, freight volume and revenues decreased year-on-year.

- As a result of the above, revenues from domestic cargo services decreased ¥0.4 billion (down 5.4% year-on-year) and revenues from international decreased by ¥0.4 billion (down 1.6% year-on-year).

- 4.Others

- ・Other revenues from the Air Transportation business, which includes ANA’s mileage program, maintenance services for other airlines, and Vanilla Air, rose ¥8.4 billion (up 22.1% year-on-year).

- ・Vanilla Air began operations at Narita Airport's new terminal from April, while also working to capture demand through starting to sell tickets further in advance dates and opening sales through specific travel agencies. In addition, Vanilla Air introduced a new yield management system in March to strengthen profitability by optimizing fare structure. During the first quarter, Vanilla Air carried 392 thousand passengers (up 98.0 % year-on-year), achieving a passenger load factor of 83.8%(up 24.1 points year-on-year).

- Airline Related, Travel Services, Trade and Retail and Others

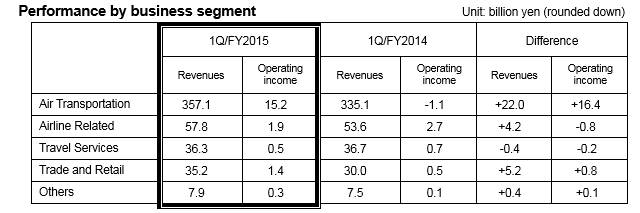

- ・In Airline Related businesses, operating revenues for the period were ¥57.8 billion (up 7.9% year-on-year) due to an increase in contracts for ground support operations at Haneda and Kansai (Osaka) International airports. Operating income was ¥1.9 billion (down 30.8% year-on-year), however, due to factors including an increased operation-linked costs.

- ・In Travel Services, operating revenues from domestic travel services were up year-on-year due to solid sales of mainstay products particularly to destinations in Kansai and Okinawa. ANA also captured steady demand for in-bound travelers to Japan. However, operating revenues from overseas travel services decreased year-on-year due to the impact on terrorist incidents in Europe and the spread of the MERS infection in South Korea. As a result, operating revenues for the first quarter decreased slightly to ¥36.3 billion (down 1.1% year-on-year) and operating income was ¥0.5 billion (down 28.6% year-on-year).

- ・In Trade and Retail, duty free airport sales grew mainly due to increasing number of in-bound travelers to Japan. In addition, retail and avionics / electronics sales were solid. As a result, operating revenues rose to ¥35.2 billion (up 17.3% year-on-year) and operating income was ¥1.4 billion (up 164.3% year-on-year).

- ・In Others, Maintenance and Management services for building produced a solid performance, resulting in operating revenues of ¥7.9 billion (up 5.9% year-on-year) and operating income of ¥0.3 billion (up 91.6% year-on-year).

- Outlook for FY2015 (April 2015 - March 2016)

- ・ANA HD will continue to implement its “FY 2014-2016 Mid-Term Corporate Strategy” for pursuing its management vision "to be the world's leading airline group in customer satisfaction and value creation”, with the aim of optimizing its business portfolio, Continually enhancing Cost restructuring Initiatives and maximizing profitability. As the core of the group’s profitability, ANA will aim to achieve even better optimization of supply and demand on its domestic network while expanding and enhancing its international network further and pushing forward with its dual-hub strategy in the Tokyo Metropolitan area airports.

- There is no change to the consolidated financial forecast for FY2015, as announced on April 30, 2015.

Contact:Corporate Communications, ANA HOLDINGS,+81-3-6735-1111 publicrelations@ana.co.jp

About ANA HOLDINGS Inc.

ANA HOLDINGS is an aviation group with global operations and a total of 63 consolidated subsidiaries and 18 equity method affiliates. It is divided into passengers and cargo services segments as well as airline related business such as Catering and IT Services. ANA HD formed in April 2013 and is the parent company of ANA; full service carrier and Vanilla Air; LCC. ANA HD promotes a multi-brand strategy to leverage the strength of ANA brand and stimulate demand in markets not completely covered by its full-service airline offering, while expanding market share for the Group as a whole, leading to enhanced value. ANA HD has about 240 aircraft flying to 85 destinations and carrying about 47 million passengers. ANA is the largest airline in Japan by revenues and passenger numbers. Management vision of ANA HD is “It is our goal to be the world’s leading airline group in customer satisfaction and value creation.” ANA is a member of Star Alliance.

ANA HOLDINGS Financial Results for the Three Months ended June 30, 2015